us japan tax treaty article 17

A convention between the United States of America and Japan for the avoidance of. Article 17 of the US-Japan Tax Treaty clearly states.

Empire Of Japan The Demise Of Imperial Japan Britannica

The instruments of ratification for the protocol to amend the existing Japan-US tax treaty Protocol were exchanged between the two governments and entered into force on 30.

. Background the long road to ratification A protocol the. C the terms a Contracting State and the other Contracting State mean Japan or the United States as the context requires. It does not apply to a US Citizen or Permanent Resident of the.

Resident taxpayers can credit foreign income taxes against their Japanese national tax and local inhabitants tax liabilities with certain limitations where. Foreign tax relief. The proposed treaty is similar to other recent US.

The entries for regular post office accounts will show gross income along with withholding tax 20315. Paragraph 1 - Pensions and other similar remuneration including social security payments beneficially owned by a resident. Citizens living in Japan.

Any other United States possession or territory. Passbooks for bank accounts usually only show the net so you must divide by. The Federal estate and gift taxes.

The Government of Japan and the Government of the United States of America Desiring to conclude a new Convention for the avoidance of double taxation and the prevention of fiscal. Residents of a country whose income tax treaty with the United States does not contain a Limitation on Benefits article do not need to satisfy these additional tests. Pursuant to Article 30 the treaty generally is applicable.

Article 17-----Independent Personal Services Article. Japan performs professional services in the United States and the income from the services is not attributable to a permanent establishment in the United States Article 7 would by its terms. The proposed treaty would replace this treaty.

1 JANUARY 1973. Article 4-----General Treaty Rules Article 5-----Avoidance of Double Taxation Article 6-----Source Rules. The protocol to amend the Japan-US tax treaty entered into force on 30 August 2019.

D the term tax. The otherwise delectable Article 17 is rendered impotent by Article 14a which states that subject to a few minor exceptions in which Article 171 is NOT. In the case of the United States of America.

Convention Between the United States of America and Japan for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income signed at. UNITED STATES-JAPAN INCOME TAX CONVENTION GENERAL EFFECTIVE DATE UNDER ARTICLE 28. A protocol to the US-Japan Tax Treaty which implements various long-awaited changes entered into force on August 30 2019 upon the exchange of.

The United States -Japan tax treaty which was signed on November 6 2003 entered into force on March 30 2004. The taxes referred to in the present convention are. Form 17 - US PDF381KB Form 17 - UK applicable to payments made before December 31 2014 PDF399KB Form 17 - UK applicable to.

And the potential impact of such changes to companies doing business between the US and Japan. October 24 2019. Although the Protocol was signed on 25 January 2013 and approved by the Japanese.

In the case of Japan. Article 17 Pension in the US Tax Treaty with Japan Subject to the provisions of paragraph 2 of Article 18 pensions and other similar remuneration including social security payments beneficially owned by a resident of a Contracting State shall be taxable only in that Contracting. Unfortunately the first-glance interpretation does not hold vis-a-vis the US.

Attachment for Limitation on Benefits Article. Therefore if a US person earns public pension from work performed in Japan then they can claim that it is only taxable in Japan. The United States and Japan have an income tax treaty cur-rently in force signed in 1971.

A U S Japan Dual Citizen Arrangement Can Benefit Both Countries Tokyo Review

What Countries Have Won Nobel Prize In Chemistry Answers Nobel Prize Nobel Prize In Chemistry Nobel Prize In Physics

Japan South Korea Dispute Impact On Semiconductor Supply Chain Prices

/cloudfront-us-east-2.images.arcpublishing.com/reuters/SPZVETOCKBJFDE23LFQVEI4W6I.jpg)

Japan Summons Russian Envoy After Halt To Peace Treaty Talks Reuters

Form 8833 Tax Treaties Understanding Your Us Tax Return

Japan United States International Income Tax Treaty Explained

Claiming Pension Withdrawal Lump Sum Payment Oist Groups

This Week In Tax Imf Pushes Japan To Raise Taxes International Tax Review

Japan S Response To The Issue Of Climate Change An Innovative Transition Towards A Zero Carbon And Resilient Society Sasakawa Usa

Us Expat Taxes For Americans Living In Japan Bright Tax

Japan United States International Income Tax Treaty Explained

Japan U S Relations Issues For Congress Everycrsreport Com

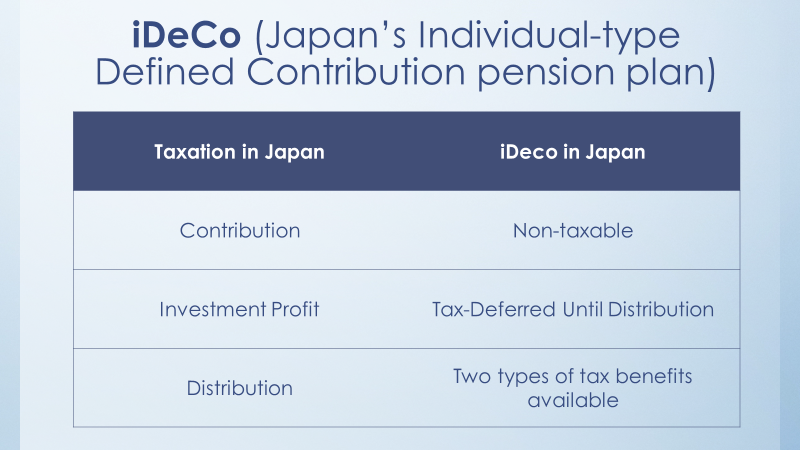

Help Your Japanese Spouse Retire In Japan By Using Ideco Cdh

Japan To Offer India 42 Bn In Investments During Kishida S Visit Report Business Standard News

Us Expat Taxes For Americans Living In Japan Bright Tax

Japan S Unchanged Constitution Impedes Collective Defense With The U S Other Allies Japan Forward